For almost all, to order property would-be probably one of the most pricey purchases of their lifestyle. It is absolute for most of us to search for an effective way to help to lower the responsibility of this costs. When selecting a property, there are two parts into mortgage payment: prominent and you can notice. According to state of markets and private affairs such as your credit rating, records, and you will quantity of financial obligation, your own bank will establish exactly what your interest rate will be with the the purchase you will be making.

Whether or not pricing are highest or not, you are going to easily feel put to several the fresh new terms, together with home loan factors. These kinds of situations play a critical role within the choosing the brand new price of the home loan. We’ll falter what mortgage circumstances was, how they may make it easier to pick off your interest, just what prices will look particularly, and whether or not they try tax-deductible.

Just what are financial activities?

Financial affairs, as well as generally known as dismiss facts, is a variety of prepaid attention which is repaid in the time of closing in exchange for a reduced rate of interest on the the real estate loan. Fundamentally, you are using a charge to buy down your interest rate. These can be purchased for brand new purchases or even for refinances.

If you purchase a property within current cost and pick maybe not to get off the speed, you will get a zero-part mortgage. Due to the fact title indicates, there’s no upfront percentage of write off facts. We’re going to touch on advantages and you can cons of getting off your speed inside a bit.

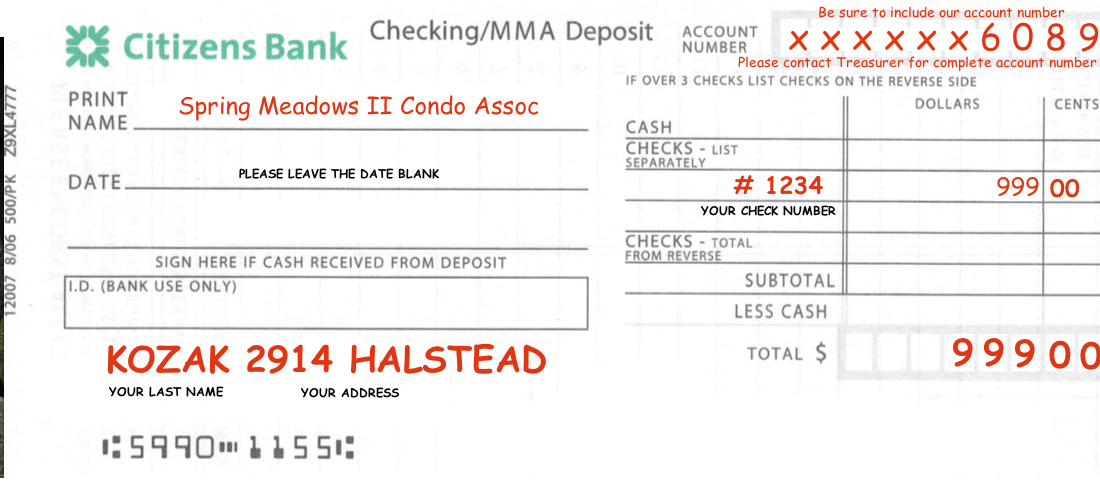

Generally, for every part one a borrower shopping will set you back 1 percent of your financial matter. For example, when you are borrowing from the bank $two hundred,000, buying one write off section perform prices $2,000 (1% of the loan amount) and may also decrease your interest of the as much as 0.25%. You can buy a portion of a spot otherwise around possibly step 3 points, depending on the situation. Deals can differ of the bank and generally are influenced by items such as for instance the condition of the market and your creditworthiness.

Financial factors is paid in the closure and also be put into the most other closing costs. But not, having fun with vendor concessions will help offset one to rates to have a buyer, so they really will need to render less of your budget so you’re able to closure. A merchant-paid rates buydown, particularly in times when the vendor are given decreasing the asking cost of a house, can have good-sized advantages for both the supplier as well as the buyer.

Higher home loan pricing can definitely sideline people and you may manufacturers, but i remind your not to help large prices deter you of selling or buying. You can find things that your own home loan company will perform to assist make process smoother and provide you even more possibilities if it comes to the expense of home financing.

Home loan Things against. Origination Items

It is critical to keep in mind that Mortgage Situations vary than Mortgage Origination Circumstances. Origination issues refer to the fresh charge that come on lender to purchase procedure of protecting your home mortgage. Have a tendency to, these costs is an integral part of what most somebody are not see while the settlement costs, and these are owed at closing. Mortgage Origination affairs dont affect the rate of interest.

Positives and negatives of buying Mortgage Situations

For each and every borrower and you will financial will be in a different sort of disease, however, listed below are some general direction to follow when considering the fresh new price of financial things.

Duration of Stay

If you are planning for the residing in your home having good long time, it might build more experience to purchase things and lower your own speed. Purchasing your speed off is lessen the overall cost of your own financial the fresh longer youre spending involved. If you are planning on being in your house getting a smaller timeframe, committed it would elevates to break also on that upfront pricing might possibly be greater than the time you want towards remaining in our home in which case a beneficial buydown may well not sound right. If you intend towards and make even more payments towards mortgage the week, this may along with weighin to the whether to invest in items seem sensible to you.

Who is spending money on brand new items?

As much as possible focus on your realtor as well as the merchant so you can safer supplier concessions to assist get off their rate, taking a merchant-paid back buydown have a tendency to economically help you significantly more than simply if that supplier lowers the latest marketing cost of the house. People provider-paid back settlement costs otherwise situations can be its build a big difference to own potential buyers. To find explains out-of wallet as well as may well not seem sensible to own those people people on a tight budget to own initial can cost you.

Monthly Mortgage repayment

While you are inside market in which pricing are highest, to find off your rate will save you serious money. It can suggest the difference off hundreds of dollars a month on your homeloan payment. Down interest rates tend to equivalent down monthly obligations, and most, that it differences will establish their ability to pay for to get a house. Lower monthly premiums assist in cashflow, plus, if you’re of your property for enough time, it will very save some costs along side life of the newest financing.

Try factors towards a mortgage tax-deductible?

To invest in points with the a home loan are taxation-deductible. Home loan notice was income tax-deductible; hence, as the discount factors are believed prepaid desire, they’ve been something that you can be deduct on your taxation.

Deductible Situations

- The borrowed funds are safeguarded by your top household.

- The newest affairs was indeed a reputable portion of the loan amount.

- Brand new activities were utilized to reduce the pace.

Non-Allowable Affairs

Circumstances paid on fund for secondary houses or financing installment loans online Delaware features generally cannot be deducted in the year they certainly were repaid but can feel deductible along side longevity of the loan.

Look for more info on taxation-allowable home loan facts for the Irs site right here. For those who have questions, it certainly is a smart idea to consult with your loan advisor otherwise an income tax elite.

The conclusion

Fundamentally purchasing mortgage items will make sense for the majority of individuals, without for other people. Due to this fact it is critical to run a beneficial lender particularly Homestead Economic Home loan therefore we normally take a seat to you and you may walk-through your own quantity to make sure it’s the best decision for the condition. Even though many folks are curious when the Fed have a tendency to straight down appeal cost of course, if they should wait to order property, we believe you’ll be able to that you might indeed want high prices when you are looking property. Within our economy, highest cost can assist contain the battle and you will home values off. Using a great buydown may help keep costs straight down, and if you’re on the fence or want to learn more regarding the choice, please reach out-we are right here 24/seven to simply help.