Welcome To Auto Flow

“AUTO FLOW” providing services to the AUTOMOBILE INDUSTRIES for the last 25 years, In this period, We set up many new FASTENERS according to new vehicles in India. Now AUTO FLOW popular by brand AFLO in indian market. AUTO FLOW deals in COLD AND HOT FORGE FASTENERS, and also deal in any type of AUTOMOBILE FASTENERS

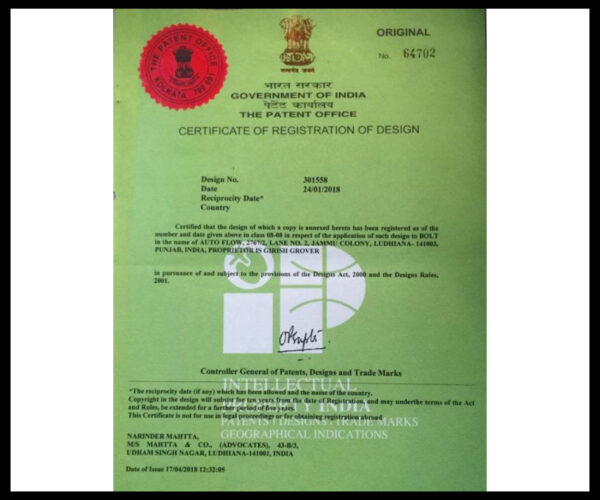

Our Achivements

We're here to help you get started in the right direction with your project.

- AFLO Wheel Nuts are better than O.E.M

- AFLO Wheel Nuts providing 6 crore product quality liability insurance. From this customer can understand Strength of our product.

- Nation Wide Network

- Focus only on after market replacement parts in India

25

Years of Experience

707

Projects completed

We take care of the environment

We have a commitment to the community and the environment in each of the regions

where we carry out our production activities. We take care of natural resources

and protect native ecosystems.

Get in Touch

If you’ve got questions or ideas you would like to share, send a message. For anything more specific, please use one of the addresses listed below.

AUTO FLOW,

2767/2, Lane No.2, Jammu Colony, Ludhiana, Punjab, India-141003.

Support

0161 5021563

Commercial

+91 9316919570

Our Email

info@afloexports.com

Let's Talk About Your Project

After we get some information from you, we’ll set up a time to discuss your project in further detail.